And South Africans Are Ready to Pounce

South African investors are increasingly recognizing a fundamental truth: the highest growth and stability are moving beyond the JSE. With limited domestic growth and rising volatility in public markets, even major financial institutions like Sanlam and Futuregrowth are actively shifting substantial capital into private markets—a domain traditionally reserved for institutional funds and the ultra-wealthy.

These exclusive markets—encompassing private equity, infrastructure, and unlisted real estate—offer powerful characteristics rarely found in public stocks: contracted income, inflation protection, and genuine long-term capital growth. The good news? This once-impenetrable wall is crumbling.

Why Institutional Money is Fleeing Public Volatility

The shift is a strategic move to unlock superior, uncorrelated returns. Private assets, by their nature, are less susceptible to daily market sentiment and more focused on the underlying cash flows.

- Decoupling from the JSE: Private assets offer essential diversification, performing independently of the volatile local equity market.

- Focus on Contracted Cash Flow: Many private market investments are structured around long-term contracts, providing predictable income that public investments cannot match.

Residential Real Estate: Accessible, But Constrained

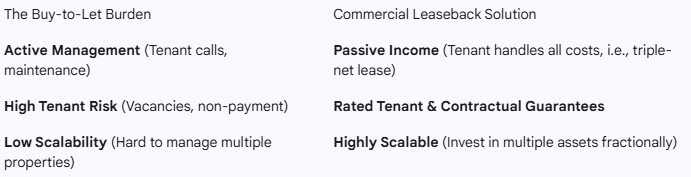

For many retail investors seeking an alternative, residential buy-to-let has been the accessible route. While it offers good yields in certain areas (like student towns and urban centres), it carries significant drawbacks that limit scalability for those aiming for institutional-grade returns:

Enter Sale and Leaseback: The Institutional Income Secret

Few individual investors are aware of the sale and leaseback strategy—a commercial real estate deal that delivers institutional-grade security and growth.

Here is how this unique private market mechanism works: A creditworthy company sells its mission-critical property to an investor, then immediately signs a long-term, contracted lease to occupy it. The result is a highly secure investment that provides the benefits institutions cherish:

- Bond-Like Income: You earn predictable, quarterly income from a rated corporate tenant.

- Built-in Growth: Leases include annual rental escalations, acting as a powerful hedge against inflation.

- Maximum Security: The investment is backed by the physical asset-backed security of the property and often strengthened by holding company guarantees.

- Market Resilience: The value of your income stream has a low correlation to stock market volatility, providing ballast for your portfolio.

This is the kind of deal—secure, high-yield, and managed—that has defined the performance of large institutional funds for decades.

Alta-X.com: Fractional Access to Institutional Wealth

The primary hurdle to accessing this high-value private market has always been the immense capital requirement. Now, platforms like Alta-X.com https://alta-x.com are fractionalizing these sale and leaseback assets, making institutional-grade commercial property accessible to the wider investor base.

Through Alta-X, you can:

- Own a Share: Invest in a fraction of a premium commercial asset with low minimums.

- Earn Passive Income: Receive your share of the quarterly lease payments.

- Maintain Compliance: All investments are conducted through a registered financial services provider (FSP), ensuring regulatory compliance and investor protection—the non-negotiable step for any serious investor.