Why Are South Africans Sitting Out of Wealth Creation?

We talk a lot in South Africa about the need for financial independence. We’re told to “make our money work for us,” that investing is for everyone, and that “cash is trash” in the face of inflation. Yet, despite the urgency around inflation, the hunger for opportunity, and the undeniable fact that the cost of living is sprinting ahead of our salaries — a strange thing is happening.

Most South Africans are not part of wealth creation, personal finance, or investment communities.

Why?

It’s not that the information isn’t out there. TikTok and Instagram reels are brimming with South African financial influencers breaking down the difference between ETFs and individual stocks in isiZulu, Afrikaans, or Xhosa. There are local YouTube channels teaching people how to start stokvels for property investment. You can start buying shares on your phone with R10.

So again — why the disconnect?

Is It a Matter of Trust?

We’ve had a rough ride. Pyramid schemes, forex scams dressed as “side hustles,” and friends who swore by crypto just before the crash — they’ve left scars. It’s not paranoia if your uncle lost his pension in an investment “club,” right? So maybe part of it is that people don’t trust investment platforms or personal finance groups — especially if it looks like another get-rich-quick scheme.

Is It Access?

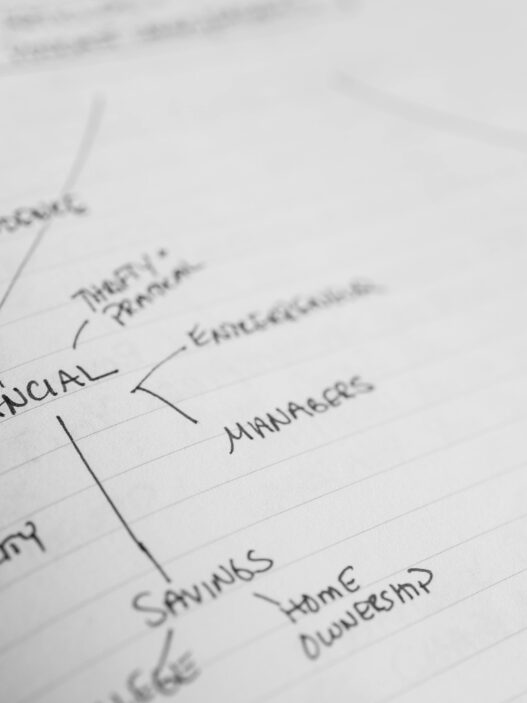

Even though platforms have made it cheaper to start investing, “cheap” is relative. When you’re choosing between saving R500 or paying for electricity, the latter wins. If the barrier to entry isn’t money, maybe it’s knowledge. People might be asking: What even is a tax-free savings account? Is that the same thing as a money market account? Is this just another bank trick?

If you didn’t learn about compound interest in school (and most of us didn’t), you’re already ten steps behind.

Is It Culture?

South Africa has a strong culture of community — from stokvels to funeral policies. But when it comes to talking openly about personal wealth, the conversation dies quickly. It’s either considered rude, flashy, or just not something “people like us” do. There’s still a myth that investing is for a certain type of person — usually someone with a degree, a steady job, and a parent who explained what a dividend is.

But what if we challenged that?

What If Wealth Wasn’t Just for “Them”?

Here’s the real question: what would it take to make wealth-building something normal? What would South Africa look like if every township had an investment club the same way it has a soccer team? If teenagers were comparing stock returns instead of sneaker drops? If being financially literate was cool?

Because the truth is, South Africans can grow wealth. We have stokvels managing billions. We have young professionals who’ve started buying shares, investing in REITs, flipping side hustles into brands.

But for that to scale, the conversation has to shift from fear to empowerment, from exclusion to inclusion. It starts in WhatsApp groups, in dinner tables, in barbershops and shebeens. It starts with someone asking:

“Wait… how did you make that money work for you?”

You can also JOIN the FFREEDOM MOVEMENT here and stay in the know!!